Nvidia has surged past global giants to become the world’s most valuable tech company. A $4.55 trillion valuation highlights the chipmaker’s dominance in the AI hardware sector. This report analyzes the market shift and future implications.

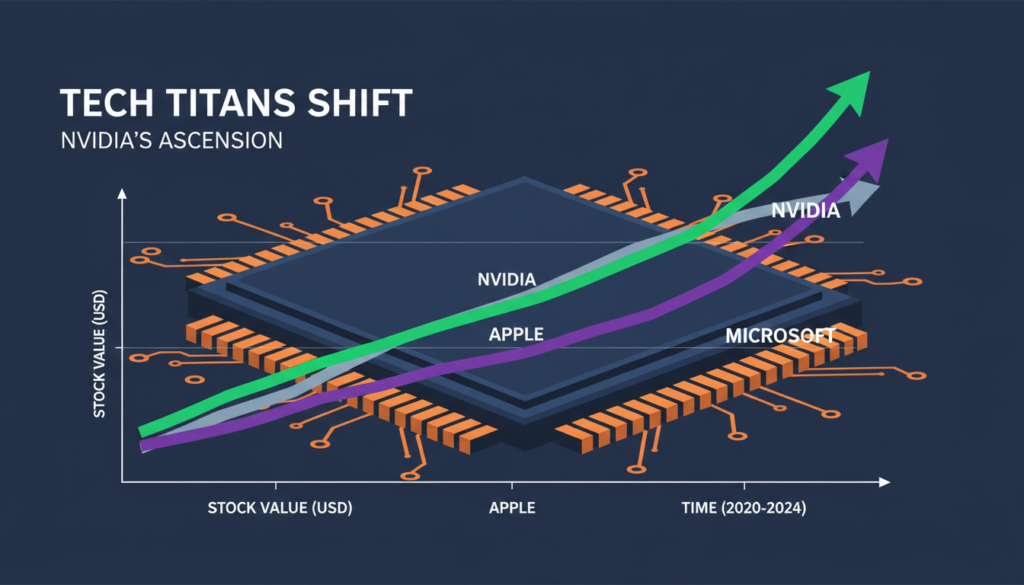

Nvidia has officially secured a historic milestone in the technology sector. The chipmaker recently achieved a staggering $4.55 trillion market capitalization. Consequently, this valuation cements its status as the Nvidia most valuable tech company. Furthermore, this surge surpasses long-standing giants like Microsoft and Apple. The growth is primarily driven by the global artificial intelligence boom. Indeed, Nvidia’s hardware is now indispensable for modern computing infrastructure.

The Strategic Ascent to the Top

Strategic planning has defined the company’s trajectory for decades. Nvidia positioned itself early as a leader in parallel computing. Initially, the firm focused primarily on gaming graphics units. However, leadership recognized the architecture’s potential for complex tasks. As a result, they invested heavily in the CUDA platform. This ecosystem now powers data centers and research labs worldwide. For more on how these systems evolve, explore our insights on Artificial Intelligence.

Driving the AI Revolution

Demand for compute power has exploded recently. Specifically, training large language models requires immense resources. Therefore, the market for Nvidia’s specialized chips is unprecedented. Cloud providers and startups alike rely on this infrastructure. Moreover, the H100 and Blackwell GPUs are vital engines. Ultimately, these processors drive the current v. You can track these advancements in our Tech News section.

Why Nvidia Dominates the Market

Analysts point to a multifaceted dominance strategy. Beyond hardware, a robust software ecosystem creates a defensive moat. Consequently, competitors struggle to replicate this integrated offering. Nvidia has effectively built a platform around acceleration. Thus, high entry barriers ensure strong customer loyalty. According to Reuters technology reporting, this creates a unique market advantage.

Economic Implications and Future Outlook

This financial milestone carries profound economic implications. It highlights a shift toward foundational infrastructure value. Companies providing compute power are positioned for massive growth. Furthermore, AI continues to permeate daily business operations. Therefore, the sector remains a critical focus for investors. Market data from Yahoo Finance reflects this sustained investor confidence.

However, questions regarding sustainability inevitably arise. Big tech rivals are developing custom silicon solutions. Additionally, startups are exploring alternative architectures. Yet, Nvidia remains the undisputed leader in Generative AI hardware. Its valuation is a testament to its pivotal role. Finally, the company’s trajectory will dictate the pace of future innovation. For official specifications on their latest architecture, visit Nvidia Data Center Solutions.